Announcing Token Utility

The Utility Engine Behind Verifiable Computation on Bitcoin

The EDGEN token is the core economic instrument powering the LayerEdge protocol — a decentralized zk-verification network designed to anchor verifiable computation on Bitcoin. It functions as both the payment medium for clients and the incentive mechanism for verifiers, aligning economic activity across light clients, full nodes, dApps, and rollups.

EDGEN is built around verifiable utility, emerging from computation submitted, proofs verified, and states anchored/finalized.

Core Token Utility

EDGEN serves as the native utility token of the LayerEdge protocol, functioning as the exclusive medium of exchange for verification-related services. Its role is tightly integrated with the protocol’s architecture—ensuring that every unit of computation, aggregation, or anchoring directly contributes to network-wide token utility.

Payment for Verification

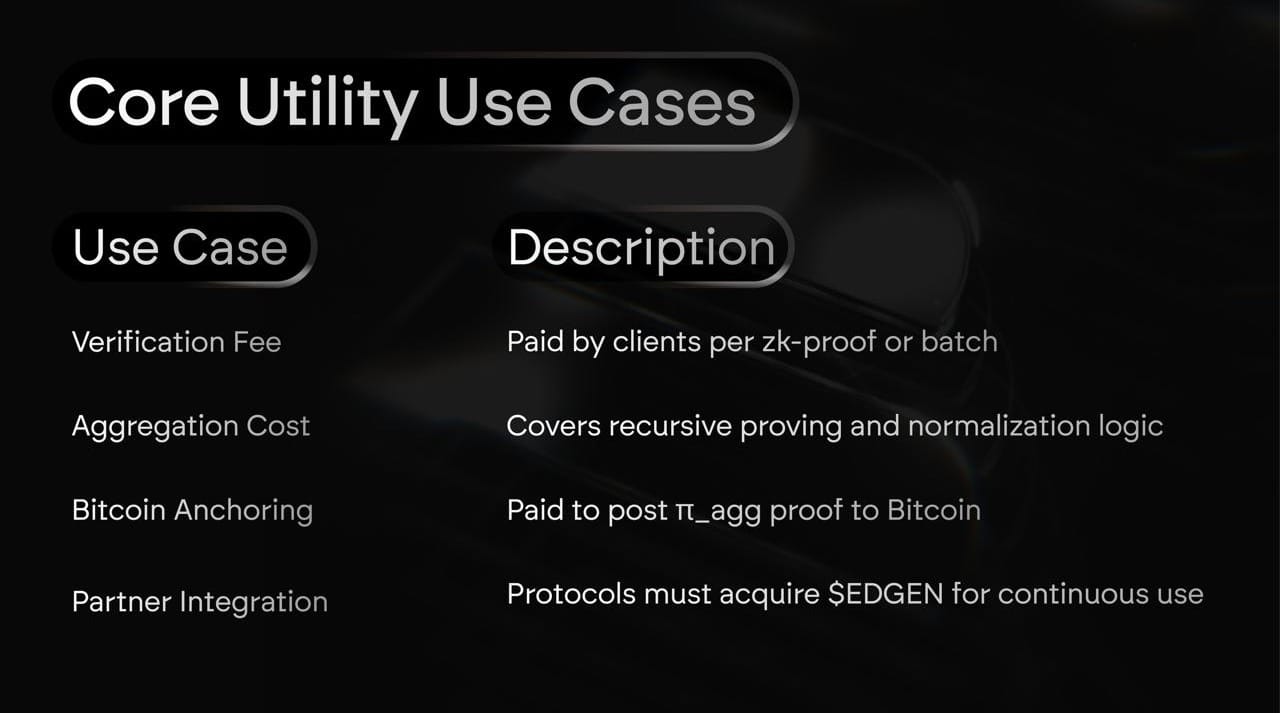

Every proof verified through LayerEdge must be paid for using EDGEN. This includes a range of services spanning from basic zk-proof validation to final anchoring on Bitcoin:

- Verification of zk-SNARKs, STARKs, and zkVM-generated proofs

- Recursive aggregation of multiple zk-proofs into a single succinct proof

- Bitcoin anchoring of the final aggregated proof (π_agg)

By enforcing token-denominated payments, LayerEdge ensures that value flows directly through the protocol.

Interoperability & Bitcoin Anchoring

Beyond individual transactions, EDGEN is also required for system-level access to LayerEdge’s infrastructure. Any protocol that wishes to leverage LayerEdge for decentralized verification must hold and utilize EDGEN for the following functions:

- Submitting proofs to the verification layer

- Requesting recursive aggregation or batching

- Finalizing computation outcomes via Bitcoin anchoring

EDGEN becomes the native “gas” token for decentralized computation verification across ecosystems.

Why a Native Token?

The LayerEdge token (EDGEN) isn’t just a transactional utility—it’s a foundational element of the protocol’s economic alignment. By embedding EDGEN at the center of both payment and reward flows, LayerEdge ensures full-cycle value capture and long-term sustainability. This approach strengthens protocol integrity while minimizing dependency on external assets or ecosystems.

Incentive Alignment

The LayerEdge economy rewards node operators (both Light and Full) in the same token that clients spend to consume verification services. This creates a powerful alignment:

- No disconnect between who pays and who earns

- Circular flow of value across users and validators

- Validators are economically invested in network reliability and uptime

This shared economic exposure across participants increases stickiness and long-term engagement.

Cross-Chain Compatibility

As LayerEdge integrates with multiple ecosystems—from Ethereum rollups to Bitcoin L2s and Cosmos chains—EDGEN functions as a universal unit of settlement for proof verification. This interoperability ensures consistent UX and streamlined billing across environments.

- One token for all integrations, from zk-rollups to AI

- Easily wrapped, bridged, or mirrored across chains

Note: By standardizing payment flows across chains, LayerEdge positions EDGEN as a multi-ecosystem verification currency, reducing fragmentation and operational complexity for integrated protocols.

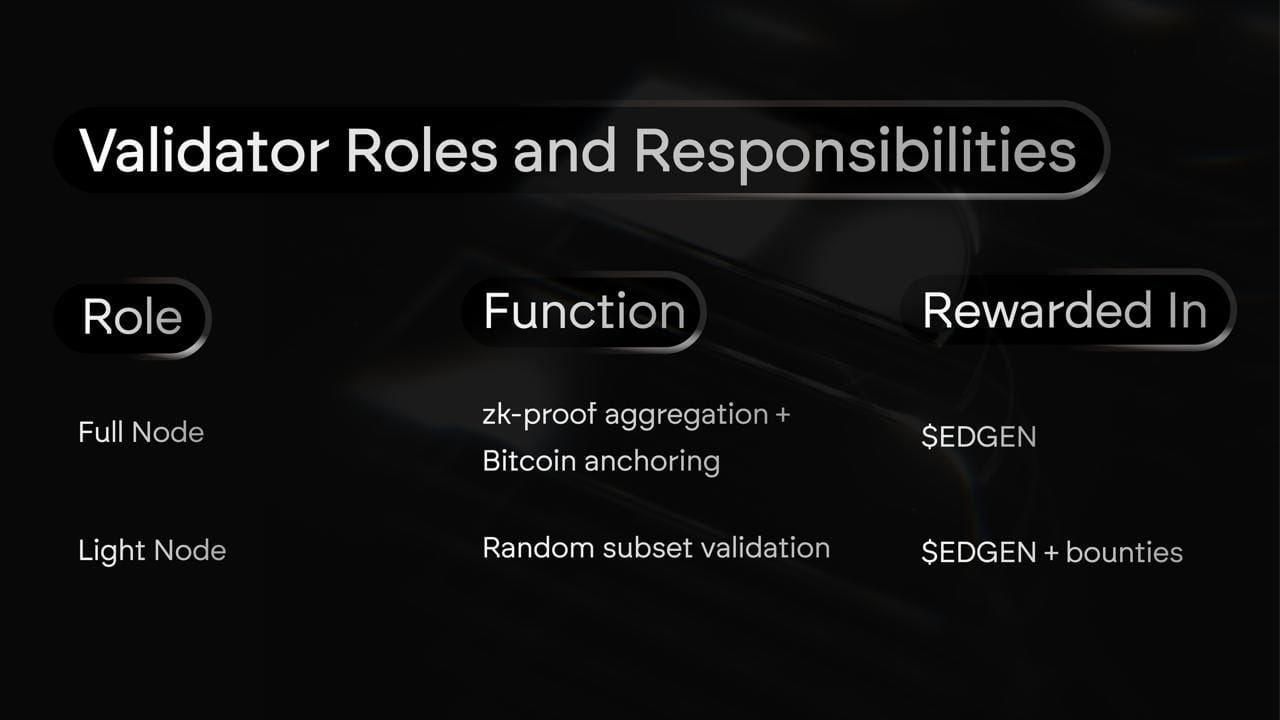

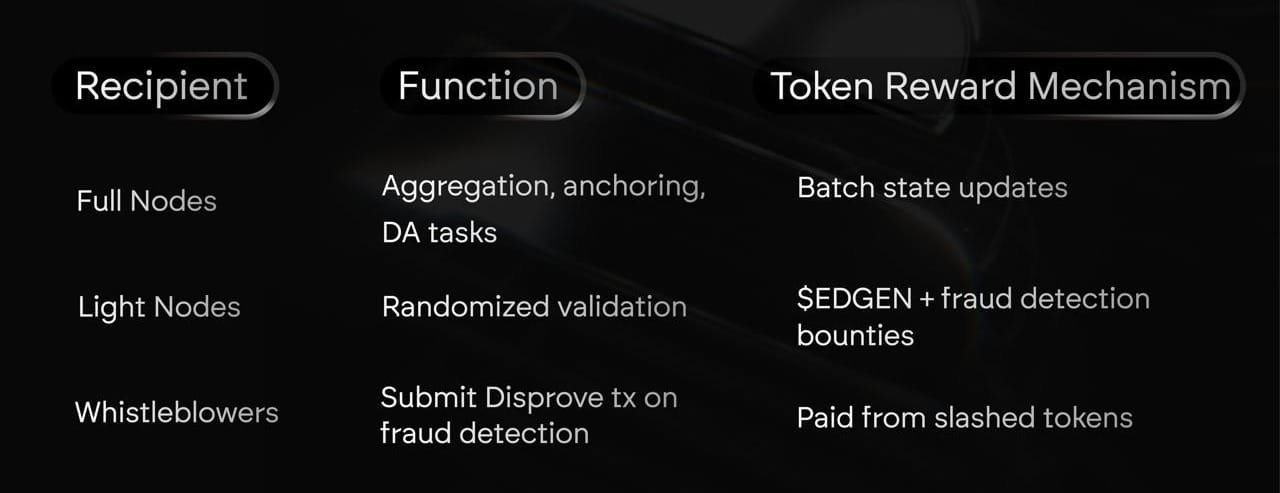

Participant Roles and Incentive Distribution

The LayerEdge protocol relies on a two-tiered validator architecture to maintain decentralized zk-verification at scale. These roles—Full Nodes and Light Nodes—ensure that both high-throughput aggregation and distributed verification can occur efficiently. Each role has distinct responsibilities, resource requirements, and reward pathways, contributing to a robust and resilient verification network.

Full Nodes

Handle heavy-lifting operations like zk-proof aggregation, anchoring proofs to Bitcoin, and optionally interacting with the Data Availability layer. These nodes are typically run on more powerful infrastructure and form the backbone of the aggregation pipeline.

Light Nodes

On the other hand, verify randomly selected proof subsets using cryptographic sampling (e.g., via VRFs or Bitcoin block hashes). They are designed to be lightweight and widely distributed, making them ideal for grassroots participation and broader network decentralization.

Both roles are rewarded in EDGEN—ensuring that correctness, uptime, and honest participation are consistently incentivized.

Note: This dual-validator model enables both scalability and decentralization—offloading computational intensity to Full Nodes while empowering broad community participation through Light Nodes.

Slashing, Bounties & Fraud Prevention

LayerEdge incorporates a robust crypto-economic defense system to maintain the integrity of its decentralized verification layer. The protocol combines bounty incentives for fraud detection with slashing penalties for dishonest behavior—ensuring that correctness is both economically enforced and community-auditable.

When a node identifies an invalid or manipulated proof, it can trigger a Disprove Transaction to challenge the faulty verification. If the challenge is successful, the honest actor receives a bounty paid directly from the slashed stake or escrow of the malicious party. This mechanism encourages proactive monitoring and decentralizes fraud prevention across the network.

At the same time, validators who fail their responsibilities face automated slashing. This includes signing off on incorrect proofs, failing to perform verification duties reliably, or attempting collusion or censorship within the network.

Key Enforcement Mechanisms:

- Bounty Incentives:

- Honest nodes can earn rewards by flagging invalid proofs

- Rewards come from the slashed tokens of dishonest participants

- Slashing Conditions:

- Signing or endorsing fraudulent proofs

- Failure to fulfill uptime or correctness guarantees

- Coordinated misbehavior, including censorship or collusion

Together, these mechanisms establish a self-correcting, economically sustainable trust model—where honest participation is rewarded and dishonest behavior is penalized at the protocol level.

Use Case Breakdown

By aligning token utility with ongoing computation and verification, LayerEdge builds a sustainable, usage-backed crypto-economic foundation.

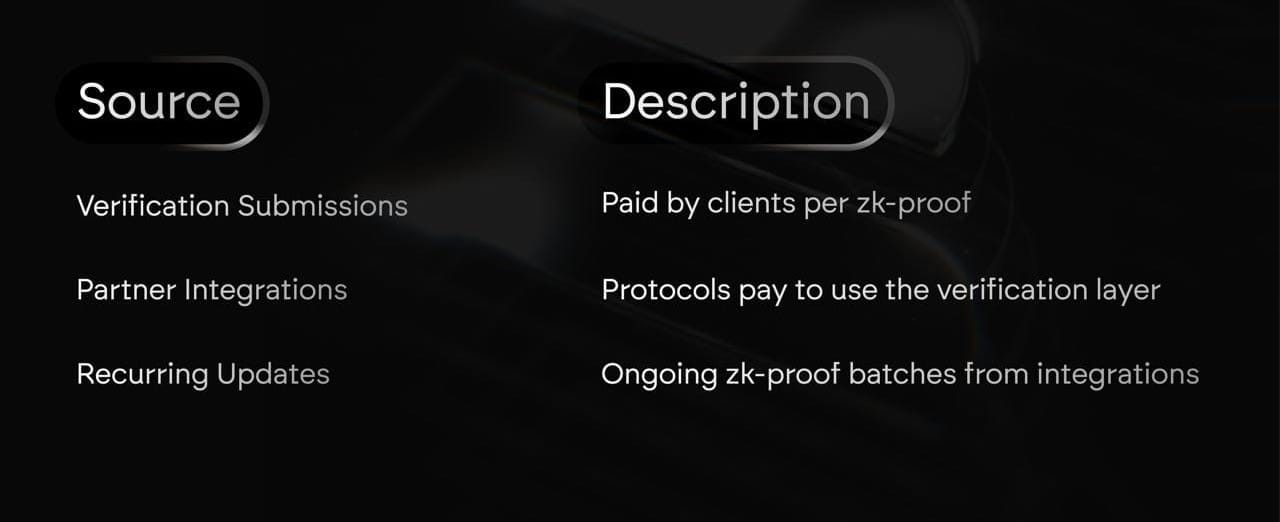

Token Flow: Utility and Distribution

At the heart of LayerEdge’s incentive model lies a cyclical token flow that captures value from real usage and redistributes it to active participants. Every verification task submitted to LayerEdge—whether by a rollup, oracle, or off-chain app—introduces utility for EDGEN. These tokens are then allocated across nodes performing critical functions, creating a balanced, utility-driven economy.

Incoming Utility

Outgoing Distribution

Note: This utility-distribution feedback loop ensures that token emissions are tied to real protocol activity—while maintaining strong participation incentives.

Adaptive Economic Equilibrium

LayerEdge is designed to dynamically adapt to real-world usage. Rather than hardcoding fixed reward schedules or relying on speculative token flows, the protocol constantly monitors network activity to calibrate validator incentives.

When usage is high, more EDGEN tokens are circulated to active verifiers. When activity drops, emissions contract automatically—preserving sustainability and eliminating waste. This ensures that only productive work is rewarded, preventing inflationary leakage and keeping token velocity aligned with utility. This prevents overpaying idle validators and keeps rewards sustainable.

Dynamic Adjustments

LayerEdge’s economic parameters are designed to be dynamically adjustable by the protocol itself—without requiring tokenholder voting or external governance processes. This ensures the system remains responsive to real-world conditions while maintaining economic neutrality.

The protocol can autonomously adjust:

- Base verification fees

- Reward emission rates

- Slashing penalties and dispute conditions

- Challenge thresholds for fraud detection

These adaptive levers allow LayerEdge to respond to network congestion, validator saturation, or shifting demand patterns—preserving balance and scalability at all times..

DISCLAIMER

THIS POST IS FOR INFORMATIONAL PURPOSES ONLY. IT IS NOT AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY ANY EDGEN TOKENS, NOR DOES IT CONSTITUTE A PROSPECTUS OR OFFERING DOCUMENT OF ANY KIND. NOTHING IN THIS DOCUMENT SHOULD BE CONSTRUED AS INVESTMENT, LEGAL, TAX, OR OTHER PROFESSIONAL ADVICE.

Token distribution models, utility design, and projected usage metrics are subject to change. All forward-looking statements are non-binding and may be revised in response to regulatory guidance, market conditions, or protocol-level decisions made by the LayerEdge Foundation.