Introducing $EDGEN Tokenomics

What is EDGEN ?

EDGEN is the gas token of the Edgen Chain and the backbone of the people backed internet.

Total Supply: 1,000,000,000 EDGEN

Ticker: EDGEN

Token standard: ERC20

Allocation to the community : 46%

LayerEdge's native token, EDGEN, has a total supply of 1 billion tokens, with 46% gradually going to the community.

EDGEN will be primarily available on the Ethereum chain, with bridges to Binance Smart Chain (BSC) and Edgen Chain (Alpha Mainnet) for cross-chain access and utility.

EDGEN Utility: Gas, Verification & Staking

In the People-Backed Internet, verification is no longer capital-bound — it’s people-powered.

EDGEN is the native token that fuels the LayerEdge ecosystem: powering proof validation on edgenOS and economic coordination on Edgen Chain. It transforms everyday devices into verifiers, rewarding participation while enabling scalable, programmable trust across chains.

Gas: Powering the Edgen Chain Economy

As the native gas token of Edgen Chain (EVM-compatible), EDGEN supports smart contract execution, task reward flows, staking, and future coordination modules.

But gas is just the beginning.

Verification: Fueling edgenOS

edgenOS turns laptops and browsers into lightweight zk-verifiers. EDGEN is the reward mechanism for those contributing compute and uptime to validate proofs.

Applications and clients also use EDGEN to price and settle proof validation tasks. Whether it’s a zk-rollup needing state validation or a DePIN network seeking device attestations, EDGEN is the unit used to pay for trust — turning verification into an on-chain primitive.

Staking: Aligning Verification with Ownership

Staking EDGEN secures the verification economy and aligns long-term incentives across the network.

At TGE, staking will launch natively on the Edgen Chain.

- Any EDGEN holder can stake directly on the Edgen Chain.

- Staking is non-custodial, and supports tiered systems, daily claims, and full reward tracking

- Withdrawals will include a short cooldown period to maintain cryptoeconomic security

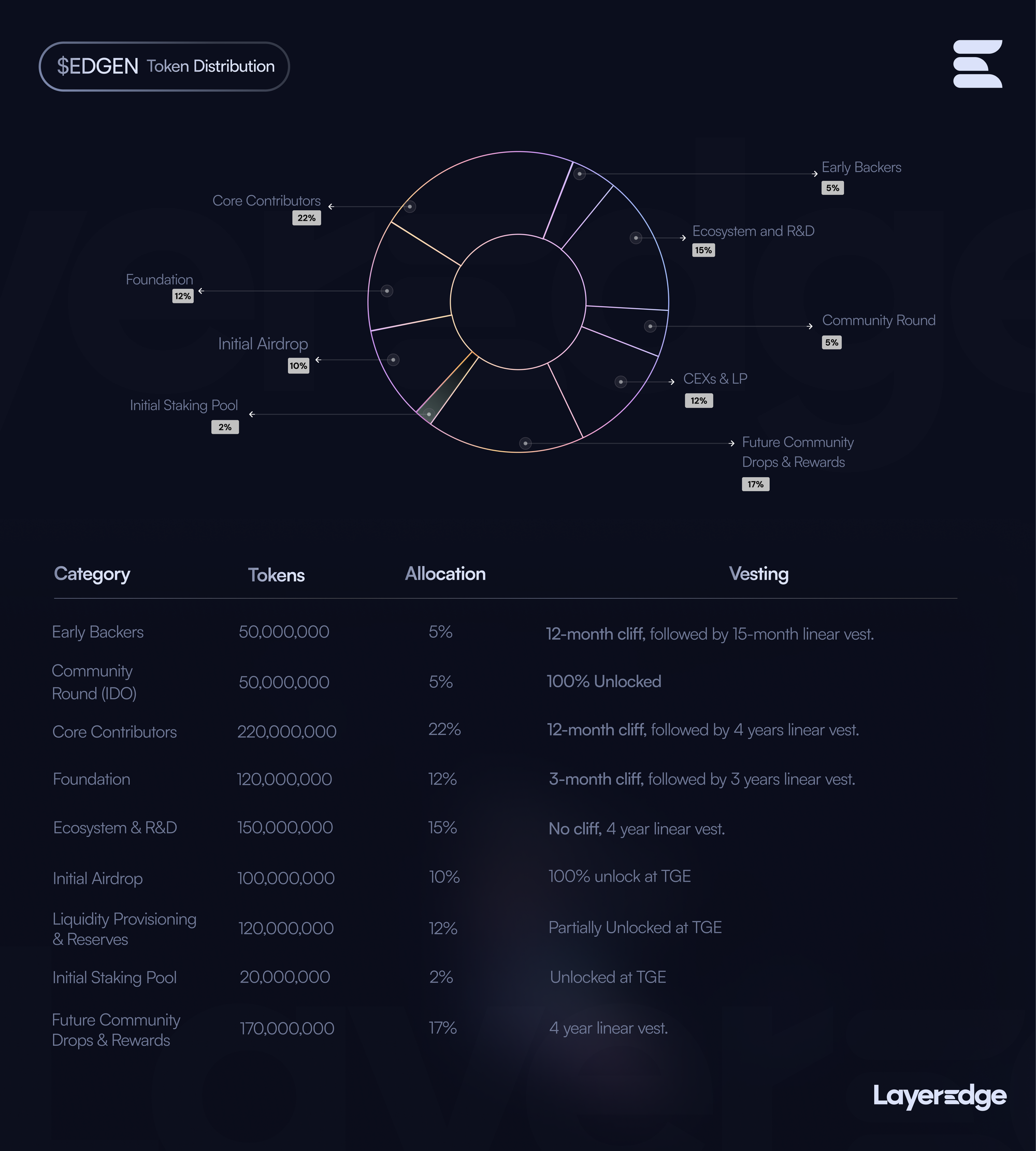

Distribution:

Breakdown

Initial Airdrop: 100,000,000 EDGEN (10% of total supply)

The network wouldn’t exist without its early verifiers, OG supporters, and the community who showed up across testnet phases. That’s why 10% of the total supply is unlocked at TGE for the initial drop and immediately made available to the community.

- 6% goes to the first wave of testnet contributors via Airdrop One—fully unlocked at launch.

- 2% is allocated for 315k OG Pledge Pass holders, effectively initiating a mint-fee back as a show of long-term alignment.

- Another 2% is set aside for expanding the community—via strategic distribution to new users to grow LayerEdge’s global reach.

Liquidity Provisioning & Reserves: 120,000,000 EDGEN (12% of total supply)

To ensure $EDGEN is tradable, accessible, and widely distributed, 12% of the total supply is allocated to liquidity provisioning and reserves for initiatives around EDGEN. These tokens serve a broad set of use cases: from bootstrapping liquidity and reserves to powering future LayerEdge campaign initiatives and expanding global access.

5% of this reserve is immediately available at TGE. The remaining 7% is reserved for strategic deployment in upcoming phases—focused on expanding user reach, strengthening token accessibility, future CEX Listings.

Initial Staking Pool: 20,000,000 EDGEN (2% of total supply).

At TGE, 2% of the supply is allocated to staking pools—rewarding users who participate in securing the LayerEdge ecosystem via non-custodial staking. Whether you’re running an edgenOS node or simply holding $EDGEN, you’ll be able to stake and earn—aligning ownership with participation from the very beginning.

Future Community Drops & Rewards: 170,000,000 EDGEN (17% of total supply)

When LayerEdge launched, it wasn’t just about rewarding the early few — it was about building an infrastructure that keeps giving back as the network scales. That’s why 17% of the total supply is reserved exclusively for future community campaigns, upcoming phases, verifier incentives and onboarding initiatives for new users entering the community.

It’s structured to vest over four years, ensuring there’s always fuel to reward participation as the network evolves. Whether it’s onboarding the next million verifiers, this pool is how the community stays at the core — not just now, but always.

Airdrop checker will go live on 31st May on https://airdrop.layeredge.foundation/ & claim begins at TGE on 2nd June.

Community Round : 50,000,000 EDGEN (5% of total supply)

This is the most direct way to prioritize LayerEdge network participants and supporters. Conducted as a community round, this discounted raise is open exclusively to our early contributors—Testnet Phase I & II users—via whitelist for the first hour, offered at an exclusive $20M FDV. The community round will be hosted on the LayerEdge Foundation website.

Any unsold allocations from the whitelist phase will then be made available to the public for the next 23 hours, or until sold out—whichever comes first. 100% of the funds raised will be deployed into the on-chain liquidity pool for $EDGEN.

All tokens in the Community Round are fully unlocked at TGE.

This round gives early community members the best entry—not because they had capital, but because they contributed.

Early Backers: 50,000,000 EDGEN (5% of total supply)

Our earliest backers supported the vision when LayerEdge was still in its earliest stages. This includes angel investors and strategic funds who believed in our journey.

These tokens have a 12-month cliff and 15-month linear vesting, ensuring early capital is aligned with long-term impact.

Core Contributors: 220,000,000 EDGEN (22% of total supply)

The engineers, designers, operators, and builders behind LayerEdge have worked to push the people backed internet from concept to reality. This allocation covers both current team members and future hires needed to scale the protocol and attract the best talent in the space.

Contributor tokens are locked with a 12-month cliff followed by 4 years linear vesting—ensuring long-term alignment and sustainable development.

Ecosystem & R&D: 150,000,000 EDGEN (15% of total supply)

This allocation is reserved for protocol-level R&D, integrations with external zk-proof systems, expansion into new ecosystems (e.g., Cosmos, Solana), and research into advanced zkVM support, frameworks, and economic coordination layers.

It also powers grants, developer incentives, ecosystem development and verifier integrations with external rollups and apps. A portion of the Ecosystem & R&D might be used for community initiatives within the LayerEdge Ecosystem in future, that enables the ecosystem growth.

Tokens will vest linearly over 4 years from TGE. LayerEdge treats R&D not as a side initiative—but the backbone of continuous evolution.

Foundation: 120,000,000 EDGEN (12% of total supply)

The LayerEdge Foundation stewards the development and governance framework of the protocol, manages legal and compliance operations, ensures long-term decentralization of network upgrades, and leads education, and cross-chain coordination efforts.

These tokens are locked with a 3-month cliff, linearly vested over 3 years.

This ensures the Foundation is incentivized to grow the LayerEdge protocol transparently and with long-term community alignment.

Next Steps for the Community

Follow @layeredgefndn for official updates. Stay tuned for updates coming on the layeredge foundation website

Join our Discord to connect with community members & builders.

Disclaimer: This content is provided for informational purposes only, and should not be relied upon as business, investment, financial or tax advice. You should consult your own advisers as to those matters. References to any digital assets and the use of finance-related terminology are for illustrative purposes only, and do not constitute any recommendation for any action or an offer to buy or sell securities or any other financial instruments. This content may not under any circumstances be relied upon when making a decision to purchase or sell any digital asset referenced herein. The content speaks only as of the date indicated.